The Manitoba government reintroduces bracket creep, a sneaky tax hike that will cost taxpayers $82 million this year

Manitoba Premier Wab Kinew is punishing Manitobans for receiving a cost-of-living pay raise.

The Kinew government will stop indexing income tax brackets and the basic personal amount by inflation this year. That means your income taxes will go up even if your purchasing power hasn’t.

This is called bracket creep, and it’s a sneaky way of hiking taxes. Inflation automatically bumps taxpayers into higher tax brackets. Your taxes go up, even though you can’t afford to buy more because prices have already gone up.

And the government is hoping you won’t notice. The change was buried on just two pages in the budget and was completely missing from the government’s news release.

This tax hike will cost taxpayers $82 million this year.

But that’s just the tip of the iceberg.

The cost compounds for taxpayers because of inflation. Year after year after year.

The province will take more money from you every year without a single vote in the legislature. By stopping inflation adjustments to income tax rates, Manitobans pay more taxes automatically.

The government is also cutting the payroll tax and increasing some tax credits in the budget. But those changes combined will only save taxpayers $37.2 million. That means even with these cuts, bringing back bracket creep is still costing taxpayers at least $44.8 million more this year.

A Manitoba family making $75,000 per year already pays more in provincial taxes than similar families living in British Columbia, Alberta, Saskatchewan or Ontario. This tax hike will increase that gap.

Before Kinew reintroduced bracket creep, Prince Edward Island and Ontario were the only provinces that subjected their taxpayers to it.

But despite hiking taxes on Manitobans and planning to take in more money from taxpayers than ever before, the premier is taking out more loans and sticking taxpayers with the cost of the interest payments.

That’s because the government is spending more on almost everything this year. It’s increasing spending in almost 80 per cent of its departments compared to last year’s budget.

The government is also increasing the debt by $1 billion compared to last year’s budget. By the end of the year, the debt will be $36.5 billion.

An ongoing tariff war could reduce the government’s revenue by $559 million. That would mean even more debt piled onto Manitobans.

The government plans to continue increasing the debt until at least 2027.

Interest payments on the debt will cost taxpayers $2.3 billion this year. That works out to $1,544 per Manitoban. Debt interest payments will cost taxpayers more than $6.4 million per day.

That’s almost 10 per cent of the entire budget.

And because the government is planning to keep borrowing money, taxpayers will be hit with higher interest payments well into the future. By 2027, taxpayers will have shelled out $7.2 billion in debt interest payments because the government is failing to stop racking up debt today.

All that money spent on interest payments over the next three years is more than the government is spending on both grade school and post-secondary education this year.

In terms of tax relief, all that money wasted on interest could have instead been used to fully cut the gas tax for 24 years.

But because the government continues to borrow money irresponsibly, all of it has to be wasted paying interest on the taxpayer credit card.

The government should be cutting taxes to make Manitoba more competitive, helping Manitobans deal with tariff threats and putting more money in their pockets.

And it’s wrong to bring in sneaky tax hikes while borrowing more money with no plan to pay it back.

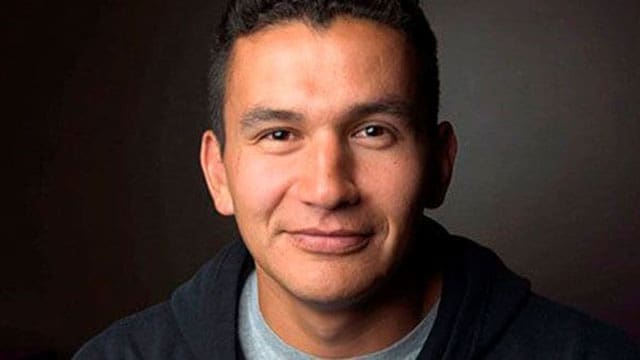

Gage Haubrich is the Prairie Director for the Canadian Taxpayers Federation.

Explore more on Kinew government, Manitoba budget, Manitoba taxes, Manitoba politics, Manitoba debt and deficit

The views, opinions, and positions expressed by our columnists and contributors are solely their own and do not necessarily reflect those of our publication.

Troy Media is dedicated to empowering Canadian community news outlets with independent, insightful analysis and commentary. Our mission is to support local media in fostering an informed and engaged public by delivering reliable content that strengthens community ties, enriches national conversations, and deepens Canadians’ understanding of one another.