Many Canadians think the recently proposed changes to the tax code are a money grab. But it could also be related to the changing face of work.

Many Canadians think the recently proposed changes to the tax code are a money grab. But it could also be related to the changing face of work.

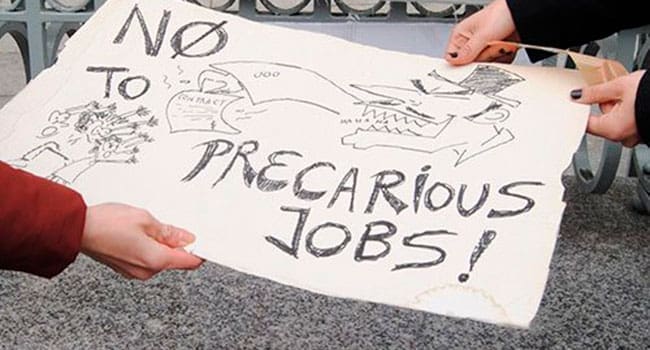

Just less than a year ago, Finance Minister Bill Morneau began warning Canadians about “job churn.” Also called “precarious work” by Morneau, it’s insecure and unprotected employment that often doesn’t support a household.

More and more companies are forgoing hiring long-term employees in lieu of short-term contracts offered to freelancers. Companies prefer to get employees off their books to eliminate the costs of benefits and pensions. They’re willing to pay more in short-term contracts to eliminate that risk.

In the new ‘gig’ economy, precarious workers often rack up several short-term contracts to pay the bills. As a result, they often set up sole proprietorships or other forms of small business in part to pay for their benefits, long-term savings, etc.

This activity known as consulting was once the domain of white-collar workers (engineers, accountants, doctors, lawyers, psychologists, etc.). However, now many non-professionals are forced to form consultancies. Of course, this change is being enabled by Internet applications and the ‘sharing economy,’ which can be a source of short-term work (think of Uber as an extreme example).

This is also leading to a predicted death (or at least dismemberment) of professions as job churners can pass themselves off as able to do work that only professionals previously did.

Of course, forming a small business based on a series of short-term contracts has its benefits from a tax perspective:

- Company profits are taxed at a lower rate (10 to 15 per cent) instead of up to 50 per cent for a regular wage earner.

- Savvy small business owners use income sprinkling, distributing the company’s profit as earnings to family members, who are taxed at a lower rate.

- Remaining profits can be invested outside the business. Any revenues generated by these investments are capital gains that are also taxed at a lower rate.

While small business owners argue that this ability to invest profits helps shore up companies through lean years, Morneau calls this and the other schemes above unfair tax dodges.

For years, the Canadian government has been turning a blind eye to the tax loopholes that small businesses have leveraged. This is because many of these tax dodges are practised by physicians and other professionals. Canada has always been at risk of losing these professionals to other jurisdictions, including the United States.

However, with the relatively unfriendly climate in the United States, the Liberal government thinks that now may be the time to tighten up Canada’s small business tax code, without fear of a massive brain drain. While this may be the case, that there may be more to this.

Soon, half the Canadian workforce will be self-employed, compared with 20 per cent now. This means Canada is at risk of losing a considerable amount of its tax base. Compare a future 15 per cent tax rate for consultants to a 50 per cent tax rate for current wage earners.

While the government argues it’s unfair to tax wage earners at a higher rate than small business owners, changing work demographics may have more to do with it. Morneau simply wants to get in front of this parade. Of course, the U.S. climate is helping.

Consultancy was once limited to well-paid professionals but now, because of job churn, it’s being forced on working families.

The government needs to recognize that struggling to assemble short-term contracts, while protecting themselves with self-paid benefit plans and managing pseudo-pensions through investments outside the proprietorship, some distinction needs to be made between highly-paid professionals and working families forced into this new work arrangement.

Derrick Rancourt is a professor in the University of Calgary’s Cumming School of Medicine, where he chairs the Graduate Science Education’s Professional Development Taskforce.

Derrick is a Troy Media Thought Leader. Why aren’t you?

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

I would like to draw to Mr Rancourt’s attention that he failed to accurately represent what taxes a shareholder (owner) of a Canadian Controlled Private Corporation (CCPC) actually pays. (Trail Times: September 12, 2017)

As a first note though, it is important to understand that this whole political discussion around business tax policy loopholes refers to the small CCPC corporations and not the sole proprietor running a business. From a tax policy perspective, his or her income from the proprietorship is treated just as any T4 earning person’s income.

Now back to Mr Rancourt’s commentary.

With his first bullet about half way thru his commentary, he does state accurately that the CCPC tax rate is 10 to 15% (depending on the province). He then compares that rate to a T4 wage earners marginal tax rate at 50%. Again, a rate that is accurate, albeit deficient in description given the fact that it could be as low as 15% due to our progressive marginal tax rate system in Canada.

To the point, Mr Rancourt has articulated a misleading comparison using the 10-15% and 50% rates he quotes. This picture is far from complete.

To make this comparison, one must consider the tax paid by the CCPC shareholder (owner) when he or she removes money (pays himself/herself) from his/her corporation. The shareholder (owner) is subject to the same marginal tax rate scheme as the T4 earner. True, if dividends are paid rather than a salary the effective tax rate is lower than the earned income tax rates, but this lucrative loophole has been plugging up for years and for all intents and purposes, is of minor tax benefit now.

Further in the commentary he states, “Compare a future 15 percent tax rate for consultants [read: CCPC shareholders (owners)] to a 50 per cent tax rate for current wage earners”.

Again, Mr Rancourt is totally misrepresenting an apple to apple comparison. That CCPC shareholder (owner) pays 10%-15% on his/her corporate profit, and THEN pays personal tax, just like any other T4 earner, on the salary or dividend “paid” to him/her in order to feed and clothe his/her children and put a roof over their head.

Ron Clarke, MBA

Trail BC